Mega Backdoor Roth 2018

1 this 1099r is for the roth in plain conversion and i think this is correct box 1 15 300 box 2a 89 box 5 15 211 box 7 code g.

Mega backdoor roth 2018. We were contemplating a mega roth conversion like you did as an alternative to keeping the money at mass mutual. I have an employer 401k at fidelity that allows in service withdrawals that i can move post tax contributions to a roth ira also at fidelity. After reading your post i think fidelity might have incorrectly filled out 1 of 2 1099rs. For a long time it was an unspoken secret used by retirement planners.

I did this for 2017 and will do in 2018 and beyond. However the irs released guidance that specifically addressed both backdoor roth ira conversions and the so called mega backdoor roth ira as a result it has gained even more popularity and interest. And that roth ira limit is even lower for employees with income greater than 189 000 filing jointly or 120 000 filing as single. Mega backdoor roth conversion.

A mega backdoor roth takes this even further. Even though the after tax contribution is an employee contribution for retirement plan testing purposes it. What is vital to know is that the success of the strategy depends heavily on your 401 k and ira providers and so you ll need to work closely with them to make sure they understand. Non highly compensated employee hce.

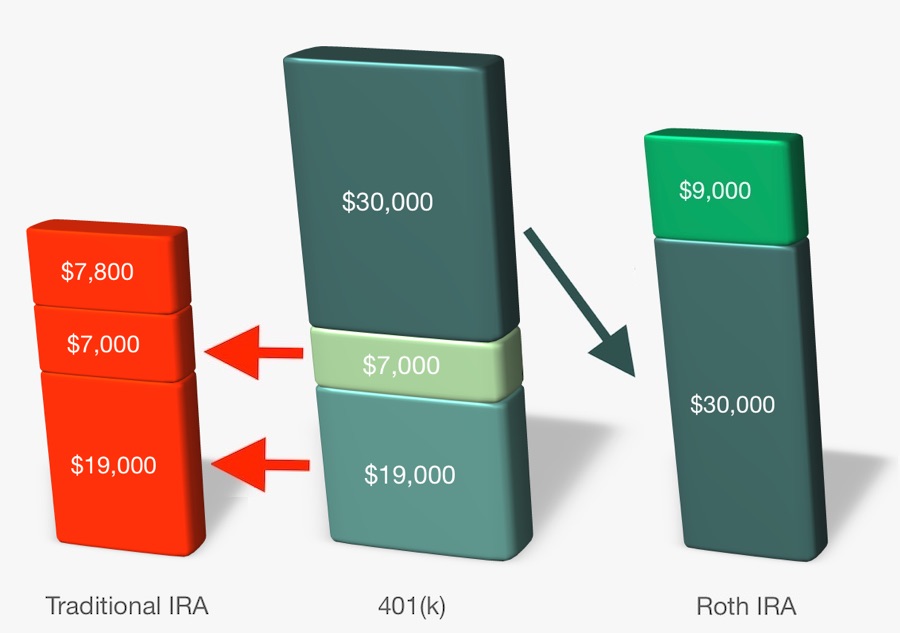

A mega backdoor roth offers the opportunity for some investors to contribute up to an extra 37 000 for 2019 to a roth ira via their employer s 401 k. We both also have backdoor roth iras at vanguard. The limit on roth deferrals in 2018 is 18 500 for a dc plan and 5 500 for an ira. Mega backdoor roth ira is an ideal indirect strategy to contribute plenty of thousands of dollars to a roth ira every single year regardless of your earnings.

Employees earning less than 120k and or not in the top 20 paid employees of company if applicable in 2017 2018. There has been a lot of talk lately about the mega backdoor roth ira. Then i have a taxable account and rollover ira from previous employer 401k at vanguard. Reasons we are leaning towards not doing the roth conversion.

The mega backdoor roth allows you to put up to 37 500 in a roth ira or roth 401 k in 2020 on top of the regular contribution limits for those accounts. So bob gives the mega backdoor roth ira a try given there are no income limitations with funding after tax contributions in a 401 k. The mega back door roth is a great concept if the right individual. 1 my income still puts us in the highest tax.